Should You Start Investing Outside of Your 401(k)?

Investing. It’s often at the forefront whenever we think about putting funds up for the future and putting our hard-earned money to work. Whether retirement is a few years or several decades away, many people want to put their money in a place where it will grow and start working for them.

While your employer may offer a 401(k) or 403(b) account, investing outside of your employer-sponsored retirement account is a common area of interest. If you’re looking to put any extra money into a different investment account, you’ll have to consider which option(s) are best for your situation and goals.

At OneEleven, we are here to help guide you along the way when it comes to making some of your most important decisions for your financial journey. Here’s what you need to know about investing outside your 401(k) plan.

Start By Making the Most of Your 401(k) Contributions

According to PwC’s 2021 Retirement in America report, one in four Americans have nothing saved for retirement. In fact, only 36% of those saving feel they are on track to have enough. If you’ve been putting money into your 401(k), 403(b), or another type of employer-sponsored retirement account, you’re doing a great job thus far.

These tax-advantaged accounts should be prioritized if offered because they have such high maximum annual contribution amounts. This year, you can contribute up to $20,500 into your 401(k) and an extra $6,500 catch-up contribution if you’re over the age of 50.

If your employer offers a contribution match, contributing enough of your salary to earn the match is basically like receiving free money (under certain vesting conditions). The amount your employer contributes also doesn’t count toward the annual contribution limit ($20,500 in 2022, source 1, source 2).

Still, a 401(k) account has its pros and cons. Your contributions are made pre-tax so you can deduct from your income when you file taxes. Also, depending on your employer’s plan, you may not have much say in what types of securities you’re investing in or how much management fees you’re paying.

If you prefer to diversify and not put all your eggs into one basket, you can certainly explore some of these additional investment options below.

Traditional IRA

An Individual Retirement Account (IRA) is a popular option for people who don’t have a 401(k) or just want to explore a different investment vehicle. With a traditional IRA, you contribute pre-tax income that grows tax-deferred.

Currently, you can contribute up to $6,000 per year and an additional $1,000 catch-up contribution if you’re over the age of 50. You can start withdrawing from a traditional IRA at age 59 and must start making required minimum distributions (RMDs) by age 72.

With a Traditional IRA, there are income limits that can reduce the amount you’re able to contribute and deduct. First off, if you’re able to be covered by a retirement plan through work, you may not be able to take the full deduction on your IRA if your income exceeds a certain threshold.

The income threshold begins at $68,000 annually if you’re single and $109,000 if you’re married filing jointly. As your income increases, you’ll be eligible for fewer deductions or there will be no deduction at all. These income thresholds are subject to change each year so be sure to check with the IRS for the latest update.

Roth IRA

A Roth IRA is an account that allows you to make contributions with already taxed dollars. This means you won’t be able to deduct contributions from your income when you file your taxes. However, you won’t pay any taxes on the money when you withdraw it during your retired years.

A Roth IRA has the same maximum contribution limits as a traditional IRA. Only, the maximum amount counts for both accounts combined. For example, you can’t contribute $6,000 to your Traditional IRA then also add $6,000 to your Roth IRA in the same year. The total maximum contribution is for all your IRA accounts so you’ll likely need to choose one over the other to focus on.

Where to Open an IRA

There are many places to open an IRA. Banks, brokerages, and roboadvisors are some of the most common options. Roboadvisors are investment platforms that use technology to select and manage a portfolio with little or no human interaction. Here are three examples of roboadvisors that offer IRA accounts:

What Will You Be Investing In?

Almost any type of investing is allowed with an IRA including stocks, bonds, mutual funds, exchange-traded funds (ETFs), annuities, and more. However, there are a few things you can’t be included in your IRA investments and this includes life insurance, antiques, and collectibles, along with real estate for personal use.

With a roboadvisor, your investments will be picked for you based on your desired level of risk.

Taxable Brokerage Account

A brokerage account is a type of taxable account you can use for investing in different securities. These accounts don’t have tax benefits like a 401(k) or Traditional IRA. However, they have fewer rules and limitations.

With a brokerage account, you can withdraw your money at any time for any purpose without a tax penalty. Another benefit of this option is that there are no caps on how much you can contribute each year.

The key is to hold your investments for at least a year to avoid a short-term capital gains tax penalty. Brokerage accounts allow you to be more hands-on with your investments and invest in stocks, index funds, exchange-traded funds (ETFs), and similar securities.

You can open a brokerage account at a range of licensed brokerage firms such as:

There may be a minimum amount you need to deposit in order to open the account while other brokerages allow you to get started with any amount of money.

Should I Start Investing Outside of My 401(k)?

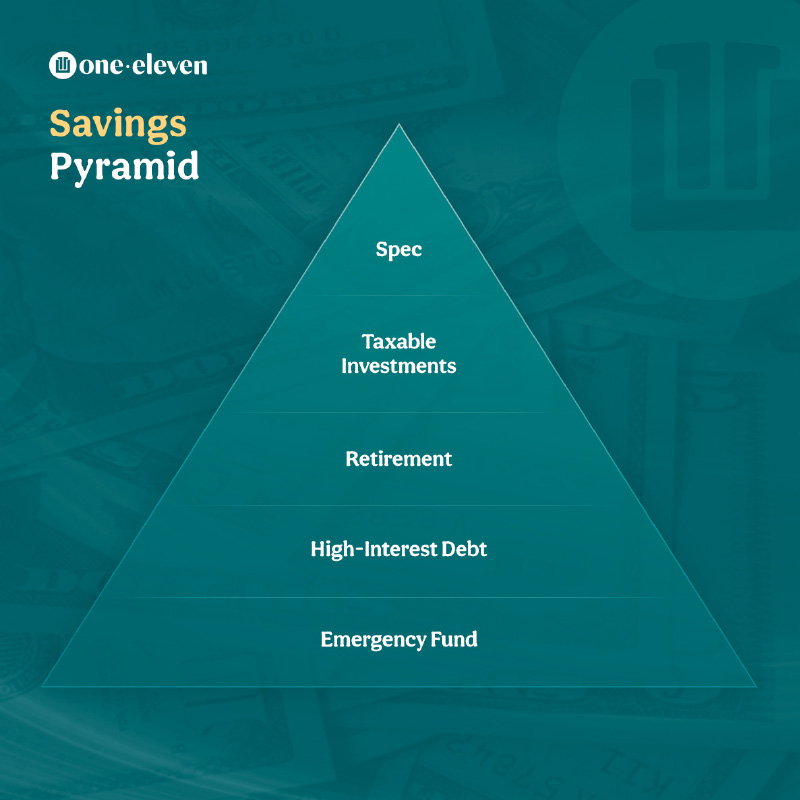

Having additional cash to invest outside of your 401(k) is always a great “problem” to have. If you have a 401(k) plan, it’s important to make sure you’re contributing to it and taking advantage of any employer match opportunities. Getting a hold on your debt and making sure you have a solid emergency fund are also key elements to address as well.

Then, you can consider some of the options listed in this article based on your situation and goals. Ultimately, working with a Financial Advisor or Wealth Coach can help provide you with the support and resources you need to make the best decision for you.

With a OneEleven membership, you get access to your own personal Wealth Team, which includes your Wealth Coach and a CERTIFIED FINANCIAL PLANNER™.

OneEleven Wealth Coach

Choncé is a Certified Financial Education Instructor (CFEI) who has 6 years of experience researching personal finance and producing financial content for sites like Fox Business, CreditSesame, and Barclaycard. She first became interested in financial wellness after embarking on her own financial journey to pay off $50,000 of debt, earn more, and regain control of her finances. She has a passion for helping others improve their finances and is honored to be able to help people firsthand when it comes to achieving their financial goals.